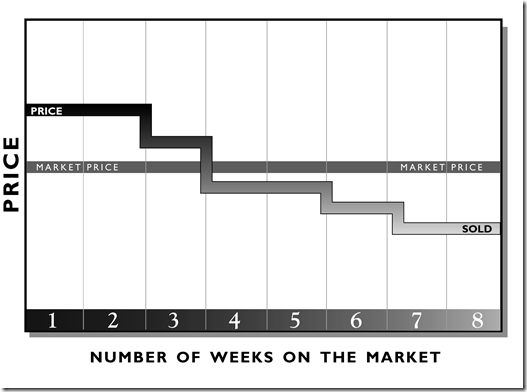

It is important to price your home right when you first list it. his along with a solid marketing plan can allow you to get the best price within the time frame you need.

It is important to know that statistics show that an overpriced home on the market more than 60 days is likely to sell at a lower price than a home priced for a quick sale. For example, lets say a home is priced at $220,000 – 10% over the $200,000 comparable market price. Three months later, the seller drops the price by 10% to $198,000, BUT the market price fell an additional 10% to $180,000 from the original market price of $200,000 just 60 days before. So unfortunately the home is still overpriced.

If you would like a market analysis for your home, or would like to schedule an appointment, we would be more than happy to help.